Compliance leaders are being asked to do the impossible—stay one step ahead of fast-moving threats, regulatory scrutiny, and operational demands, all while relying on rigid, outdated rule systems that were never designed for today’s fast-paced financial crime landscape.

Analysts drown in false positives. AML managers wait weeks for minor rule changes. Risk officers can’t explain why alerts spike—or why threats slip through. The problem isn’t just inefficiency—it’s exposure.

What’s holding them back? A rule management model that’s stuck in the past.

Why legacy rules hold compliance back

Most legacy rule systems were built for a different era—when financial products moved slower and threats were more predictable. Today, compliance officers are expected to adapt their programs in real time, but often lack the tools to do so.

Here’s what keeps them up at night:

- ⭕ Slow change cycles: Creating or updating rules can take weeks and often requires developer support.

- ⭕ Lack of visibility: Rules are deployed without a clear view of their impact, increasing the risk of alert overload—or worse, blind spots.

- ⭕ No simulation capabilities: Without a safe environment to test, every rule change feels like a gamble.

- ⭕ Disconnected risk coverage: Rules often operate in silos, without alignment to AI models or enterprise risk frameworks.

- ⭕ Explainability gaps: Justifying logic to auditors or leadership is difficult when rule creation isn’t transparent or business-led.

Empowering compliance with self-service tools

Forward-thinking institutions are breaking out of these constraints. Tools like ThetaRay’s Self-Service Rule Builder & Simulator are shifting ownership back to compliance professionals, giving them the autonomy to manage and optimize rules without technical dependencies.

You don’t need to rely on IT or data scientists. Compliance teams can easily do it themselves, quickly and efficiently.

No code. Just point, click, and your logic is live.

Let’s say we want a more complex rule, with ThetaRay’s Rule Builder, that’s completely doable—using conditions, aggregations, and time-bound filters. And it’s still fully no-code.

Want to suppress false positives? Add that logic in. Need to apply it temporarily while you assess a trend? Just select the timeframe. This is risk control at speed. You can create, modify, remove, and simulate rules with full autonomy—no developers required.

Now let’s make sure that the rule actually does what we want—without touching production.

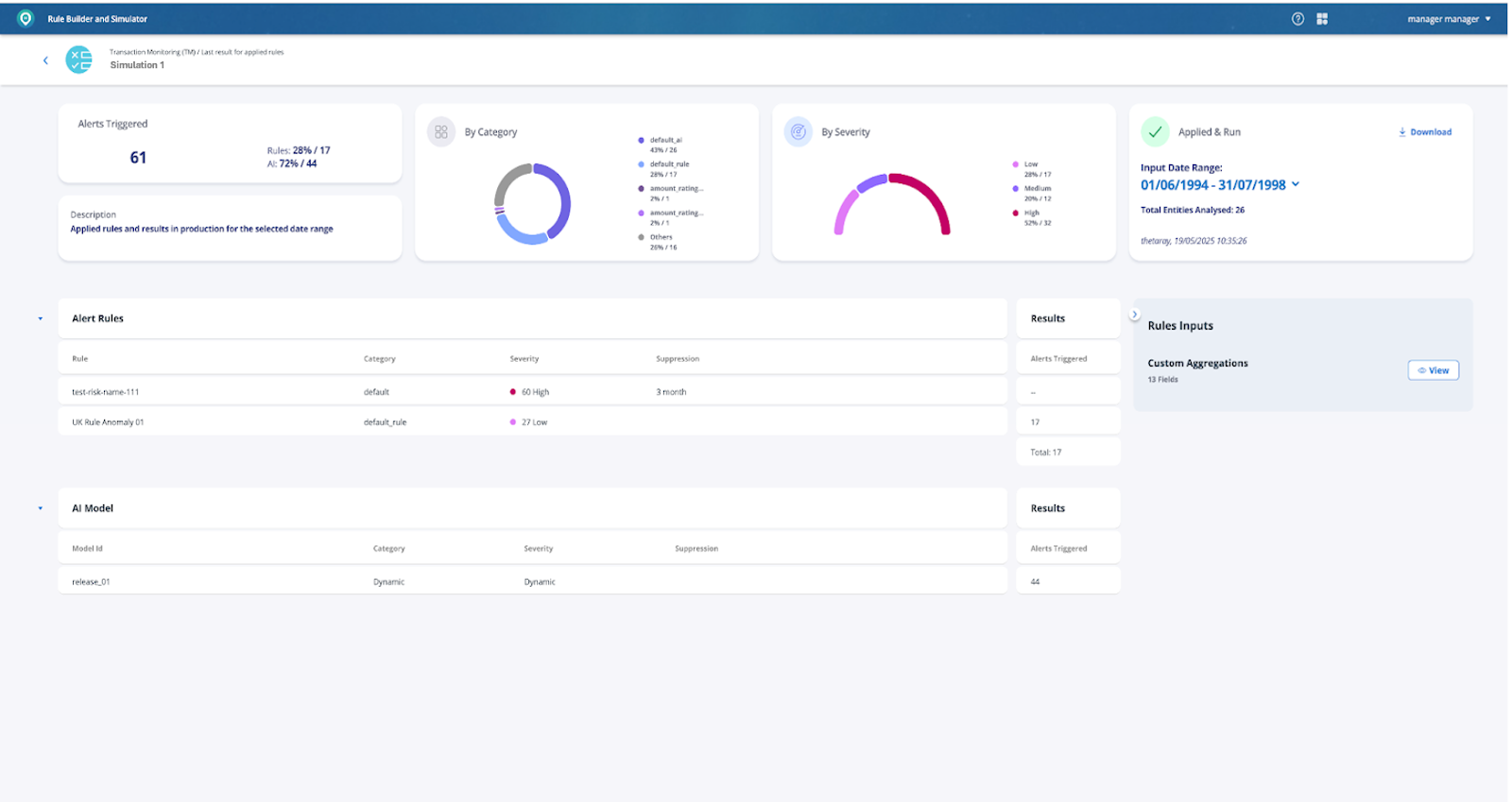

With the Self-Service Simulator, you can test any rule change across real historical data—and review results by category, severity, and ruleset.

For example, here you see that our new rule triggered 61 alerts- and a breakdown by rules and AI- no disruption to operations.

Text multiple rule versions, evaluate the effect of adding or combining rules with your existing AI models, and once satisfied—follow the built-in approval workflow to move it into production.

Here’s what this shift enables:

- ☑️ No-code rule creation: Define simple or complex logic using a business-friendly interface.

- ☑️ Real-time simulation: Test rules against real data, compare multiple versions, and preview impacts before deployment.

- ☑️ Integrated AI alignment: Understand how rules interact with AI-driven alerts for stronger prioritization.

- ☑️ Full auditability: Track every change and decision, ensuring confidence with regulators and internal stakeholders.

- ☑️Unified application across Transaction Monitoring and Customer Risk Assessment: Manage both solutions’ rules from a single module.

Cutting the noise and boosting compliance value

In practice, this self-service model has led to measurable gains for banks and fintechs:

- ☑️ Reduction in false positives, from fine-tuning rule thresholds in a safe simulation environment, to enabling analysts to focus on what truly matters.

- ☑️ 1,000+ analyst hours saved annually through faster testing and deployment.

- ☑️ Improved SAR conversion rates and audit readiness.

- ☑️ Shortened time-to-compliance when adapting to emerging typologies or regional regulations.

This isn’t just about rules—it’s about strategy. By putting compliant, adaptive tools directly in the hands of those managing risk, institutions become more responsive, more resilient, and better prepared for what comes next.

Rethinking compliance for speed and scale

Modern financial crime risk requires modern infrastructure. That starts with empowering the people closest to the problem—compliance and risk teams—with tools that give them visibility, control, and confidence.

The ability to build, test, and deploy risk logic at speed isn’t a nice-to-have. It’s a competitive advantage.

If your compliance team is still stuck in the queue for dev support, it’s time to make the shift.